Week 1

This is going to be a great experience for you.

I’ve got a ton of great trading tips for you, but for you to build upon this knowledge, we must have a clear starting point.

So, let’s start here...

What Is Strategic Trading?

Think of strategic trading as a “Meta-Strategy”.

It’s an overall strategy that contains one or more actual trading strategies or systems.

Every part of the system is there for a logical reason, and must be based on actual trading experience, not back-testing or theory.

But there is another big difference....

Most people believe investing is simply a matter of risk vs. reward. But that leaves out the biggest factor of all...

Probability!

Using these three factors: risk / reward / probability we increase the odds of success.

This is critical because most traders are losing money when they come to me and just getting profitable is a MAJOR accomplishment for most traders.

Start with the trades that give you the HIGHEST odds of success first... even if the profit per trade isn’t huge.

The biggest difference between strategic trading.

Building Your Foundation...

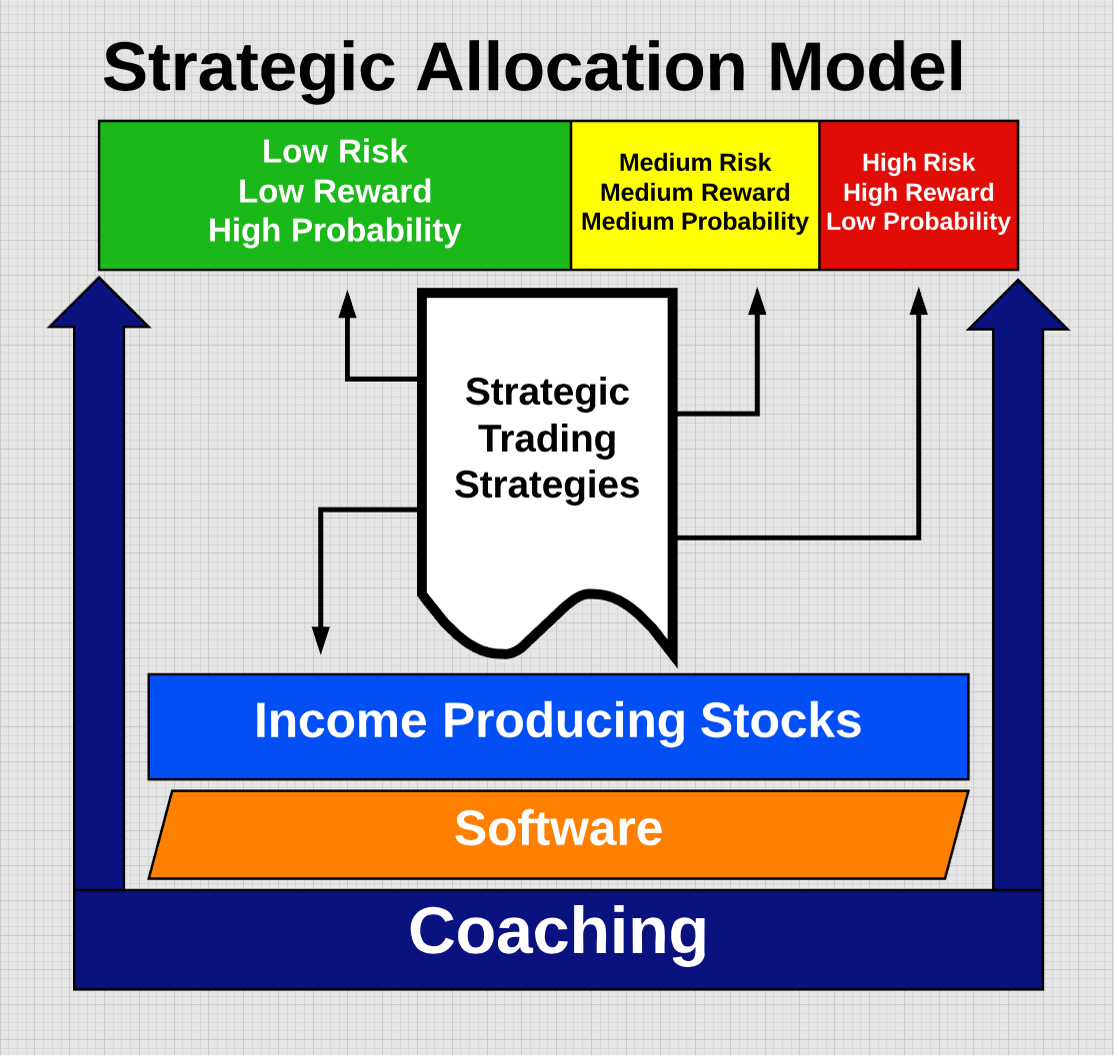

Your success is only as strong as your foundation! Now look at this model...

How “big” each box is for YOU depends on your age, capital, goals, available time and so on.

You don’t necessarily need more than one strategy, especially if you have less than $25,000 in trading capital.

If you do have ONLY ONE strategy, it should (in my humble opinion) be a low-risk, low return, high probability strategy.

Low risk, low reward, high probability short-term trades program your brain to consistently beat the market in less than a week.

Gain knowledge and confidence.

Medium risk, medium reward, high probability 2 – 15- day strategy(s) teach you how to “win some and lose some” but come out ahead, and learn how to let your winners rise, scale out, and limit your losses.

Learning how to control and exit this type of trade is a very important and time-consuming skill.

The longest-term strategies are designed to weather the long-term ups and downs of the market and specific stocks.

Longer-term holds have “distributed” risk, and “bonus’ profit capture opportunities. You learn how to be patient, to put rules in place to control downside risk, while using “add-on” strategies that make those stocks yield a “bonus” income for you.

You know what I think of high-risk strategies. They should be relegated to a small percentage of your overall account.

The different boxes are larger or smaller for different traders, due to age, capital, goals, temperament etc. – and not all boxes are necessary or useful to all traders. But the diagram applies to every trader.

You’ll notice that nowhere in this diagram have I suggested that you ...

• - Watch stock market TV,

• - read market blogs

• - join trading chat rooms

• - Look for “story stocks” that will allegedly soon “soar in price”

• - Subscribe to Cramer

• - Learn forex

• - Mention penny stocks

The Damage Done

I hear these stories all the time and it's heart-breaking:

"I started with $300,000 and I only have $5,000 left. I’m supposed to retire next year. Can you help me?"

What they are really asking is, "Are you the magic guy who can rescue me and help me turn $5,000 back into $300,000? I lost that money. I have to get it back."

This is how casino “enthusiasts” and sports gamblers have always thought.

Casinos and bookies have capitalized on these kinds of universal human weaknesses for centuries.

Hype And Distraction Waste Time And Create Trading Losses

Let's compare trading to running a business.

In reality, trading should be FAR, FAR simpler than running a business.

A business requires ...

Taking care of (and paying) and employees, putting your relationship and health on the line by often working 16-hour days, legal issues, technical issues, products, manufacturing, partnerships and joint ventures, marketing writing sales copy, marketing, tracking, maintaining your website, Facebook-ing, tweeting, book-keeping, constantly building your list and marketing to it.

On top of that, there’s more to do every day!

There's always the temptation for a business owner to believe that there is a miraculous new profit-generating secret or tool around the corner – which distracts them from running their business.

Yep, just like the world of trading, the world of online entrepreneurship is subject to a very similar never-ending stream of distracting "secrets and tools".

Most traders are already overwhelmed, BUT when they fail, they just pile more work onto themselves.

When I say "work", I mean “spending time” ... reading blogs, books and newsletters, watching CNBC, buying more courses and books, joining more trading rooms, and so on.

I am repeating myself because I want you to stop wasting your time and get focused.

In many cases, it's curiosity that makes people perpetually search for more information. The world of stocks, commodities, and currencies are in fact full of fascinating high-stakes history and enormous wealth.

But you live in the real world, so don't let fantasy affect your trading.

Stay grounded.

OK, let’s go back to this diagram...

Everything you need to be successful is in this model.

You will only need a handful of strategies and tools.

And everything in this diagram is supported by “Coaching”.

Software has been the biggest thing that turned me around as far as tools go.

That’s why I had my own software built.

Income producing stocks serve as the foundation of the portfolio.

High- yield dividend stocks for example.

In this strategy you simply let time do all the heavy lifting.

Here’s why...

Some interesting facts about dividend stocks...

Howard Silverblatt, of Standard & Poor’s, calculates that from 1926 through March 2009, reinvested dividends accounted for 44% of the 9.5% annualized return of the S&P 500-stock index ($INX).

From 1972 through April 2009, dividend growers returned 8.7% annualized, according to Ned Davis Research, compared with 6.2% for the S&P 500 and just 0.7% for stocks that paid no dividends.

Standard & Poor’s defines “Aristocrats” as stocks that have a 25-year history of annual increases in dividends.

Aristocrats delivered an average 11.04 percent return each year from 1990 to 2012 compared to 8.23 percent for stocks overall.

The June 2012 issue of Money magazine reported on research that “...found that between 1990 and 2011, the steadiest U.S. shares produced the highest returns while the most volatile domestic shares lost value.”

A 2008 study found that between 1968 and 2007, the 100 top-yielding stocks in the S&P 500 returned 13.52% annually versus 10.53% for the S&P 500 as a whole.

In 2016, several dividend stocks outperformed the S&P 500, some, like MO, by more than 60%. That’s huge.

That’s why the foundation of the Strategic Trading Model Portfolio is built on income stocks.

In this model, your largest capital allocation is in income producing stocks because it gives you the best odds of simply making money. Both through the dividends themselves and through stock price appreciation.

The next largest capital allocation would be in strategies based on their probability.

As you can see, the strategies are divided in 3 Boxes...

In Box 1, the strategies would include low risk, high probability strategies like covered calls and naked puts.

WHAT?

I know...

Some people are shocked when I say this but here’s a little known FACT...

Of all investment strategies using stock and or options, coved calls is the safest. It’s one the Chicago Board Options Exchange (CBOE) calls “the safest of all option strategies... safer than purchasing and selling stocks only.”

I’d like to repeat that...

The Chicago Board Options Exchange... The largest options exchange in the U.S... Says these options safer than purchasing and selling stocks only...

So selling covered calls on dividend stocks is SAFER than just owning dividend stocks... AND... it can increase your total return by 200% or more.

Isn’t this a weird fact? A stock + option strategy is less risky than owning stock.

Yet most investors are clueless or afraid of options.

But don’t worry, I’ll set you straight.

In a model portfolio, we’d have the bulk of our money allocated to income stocks.

The second largest allocation would be in strategies listed in Box 1.

Here, we would use stock trading strategies. And maybe a few stocks combined with option strategies.

The far-right box would contain strategies we would only use on 5%- 10% of our model portfolio capital.

The reason is because if the reward is high, the probability is low. This would include buying Call or Put Options.

This way you have the most money invested in high probability strategies and the least amount of money allocated to low probability strategies.

This is a unique way to structure a portfolio.

The main thing to keep in mind is that it is NOT based on RISK vs. REWARD like every other investor does it.

In the strategic Trading Portfolio, the allocation of the money is all based on PROBABILITY of the strategy.

Now, let’s get into some...

The Tricks Of The Trade

Today I’m going to teach you a trick that set me straight.

This one trick has helped me more than anything else and I know it will help you too.

That’s why I want you to have this trick first.

Would you like to instantly know if we are in a bull market, a bear market, or trapped in the middle?

Would you like to be able to analyze any stock in less than 3 seconds? I thought so.

That’s why the first trick I am going to teach you is what I call...

Trader Vision

Trader vision is being able to see everything you need to know in a stock’s chart.

This is critical because everything we do is based on the chart.

Here’s why...

The Analysis Secret

Whenever you look for a stock to trade, there are only two different ways to find a stock.

Those two different ways are...fundamental analysis and technical analysis.

In other words, from a “predicative” view or “reactive” view.

The guys doing fundamental analysis read tons of stuff.

They read all the company press releases, stacks piled to the ceiling of Wall Street analyst’s reports (what a joke) from every brokerage firm on Wall Street.

They read the company’s quarterly earnings reports (what a lie). Ever read one of these?

These company produced quarterly reports and annual reports are filled with jargon and accounting language that nobody can understand and some of which seems to be totally made up.

Like the “synthetic lease” found in one of Krispy Kreme Donut’s quarterly reports.

The fundamental analysts read all this stuff and more, etcetera, etcetera, ad nauseum...

From all these piles of crap they come up with calculations and stock price valuations to determine if a stock’s price is overvalued or undervalued and from there they try to “predict” the stock’s price movement.

Fundamental Analysis Is A Total Waste Of Time!

There are two reasons fundamental analysis is a total waste of time.

#1. The reason is because you cannot rely upon any information you get from the company you are researching or from Wall Street analysts.

Before I found success as a trader, I was trained as a stock broker on Wall Street so I’m telling you this as an insider –

Company Management’s Job Isn’t To Tell You The Truth... It’s To Get You To Like The Stock!

Same thing with Wall Street analysts, company management blows smoke up their skirt and the next thing you know the analyst’s brokerage firm is issuing a “strong buy” recommendation.

2. Wall Street brokerage firms have already been busted for “conflict of interest” when it comes to recommending stocks. They would issue “buy recommendations” then talk amongst their peers and friends about what a piece of shit the company was.

Nobody On Wall Street Cares If YOU Make Money, They Only Care If THEY Make Money!

You cannot trust any information you get from a company or from Wall Street!

Since you cannot trust any information from the company or Wall Street analysts, any time you spend on fundamental analysis is a complete and total waste of time.

Besides, all the relevant fundamental information is already built into a stock’s price.

And... that leads us away from fundamental analysis, into technical analysis.

Technical analysis is “reactive.” And that’s what I like about it.

Understand something: I don’t try to predict anything. I simply react to a stock’s price movement.

I like to ride trends in a stock’s price.

If the stock’s price starts moving up, I react by buying it.

So, the first thing I did that dramatically improved my results was to stop trying to find good stocks to trade based on fundamental analysis reading any research about the company and only use technical analysis to find stocks and decide when to get in when to get out.

When I say technical analysis, I mean using a stocks chart to see a trend.

A trend is a series of higher prices over time.

Using a chart’s set up will also help us filter stocks as well.

This way, when you type in a stock symbol, you can tell in about 2 seconds if it’s a good stock to trade.

We will be using Trend Point Software for our charts.

Our next lesson will be all about using Trend Point.